Now you can enjoy the firm level tools you need so that every client has great tax planning. Automated communications, streamlined setup, and better pricing means you can do what you do best....

Make clients smile.

Accountants have a choice to make every time they sit down with a potential prospect. How will you offer your services? How will you price them? What will differentiate you from other accountants?

This free eBook explores how tax planning can make closing sales easier, and even how it can bring clients through the door.

You have never seen the inside of a CPA firm like this! Christopher G. Ragain, CPA/RTP takes you inside is million-dollar accounting firm Ragain Financial with the goal of showing you how Tax Planning is the key to big profits and lots of clients.

This first video gives you an overview of the more than 15 hours of content you will see inside the Tax Planner Pro Accountant Portal.

The new Accountant Portal puts professional tax planning tools for all of your clients at your fingertips. The portal shows you all of your critical client data but is simple to navigate and teach staff members on.

Built on the same foundation as Tax Planner Pro the accountants portal has a familiar design and navigation. But with improved data entry workflow and faster setup structure you will save time and increase your effectiveness.

Deliver high quality, customized tax projection reports to your clients via a portal or .pdf document.

Deliver the information your clients are craving, every quarter, with just a click of a button.

Tax Planner Pro is a fully functioning tax projection software with the details and calculations to give your clients accurate projection information and planning suggestions.

The Accountant Portal has new features like the "Tax Savings Potential" calculator

Simply connect a client's QuickBooks file or manually enter their business income and expense. From there the Accountant Portal calculates the potential savings the client is not utilizing and you can effectively sell more business by mentioning that to the client. Best of all, we show you how in the Tax Planning Mastery course.

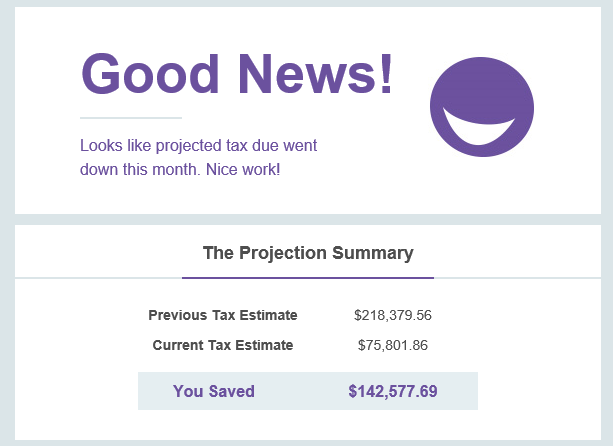

Setup each client to receive emails and reports that show them their tax estimates and details of how they are doing month to month.

Proactive accountants earn over 70% more revenue than accountants that do no tax planning at all. Turn your practice into a cash machine by simply syncing to the software you already have.

Tax Planner Pro can help you organize your client tax planning tracking with alerts and information right at your fingertips.

See connection status, projection details, tax due, and more in the consolidated client list.

Better than your tax software because we can sync to your clients accounts in real time. Both you and your customers will have real-time data, not old numbers from last year.

This FREE course had the beginner in mind from the start. We go over basic tax planning theory as well as step-by-step instruction of how to prepare simple tax plans as well as advanced concepts.

Christopher G. Ragain, CPA, the founder of Tax Planner Pro, makes tax plan training entertaining and fun, while making sure you get the very best instruction. When you finish this class, you will be a pro!

Christopher G. Ragain, CPA has done over 10,000 tax plans in his 25 year career. No one in the country has more experience or know-how when it comes to teaching you the basics of tax planning and advanced concepts.

As an added bonus, Christopher will take you through how to setup a tax planning service in your firm and how to earn big money from the offering. If you are a bookkeeper, tax preparer, accountant, CPA, or EA and you want to make more money, this course is for you!